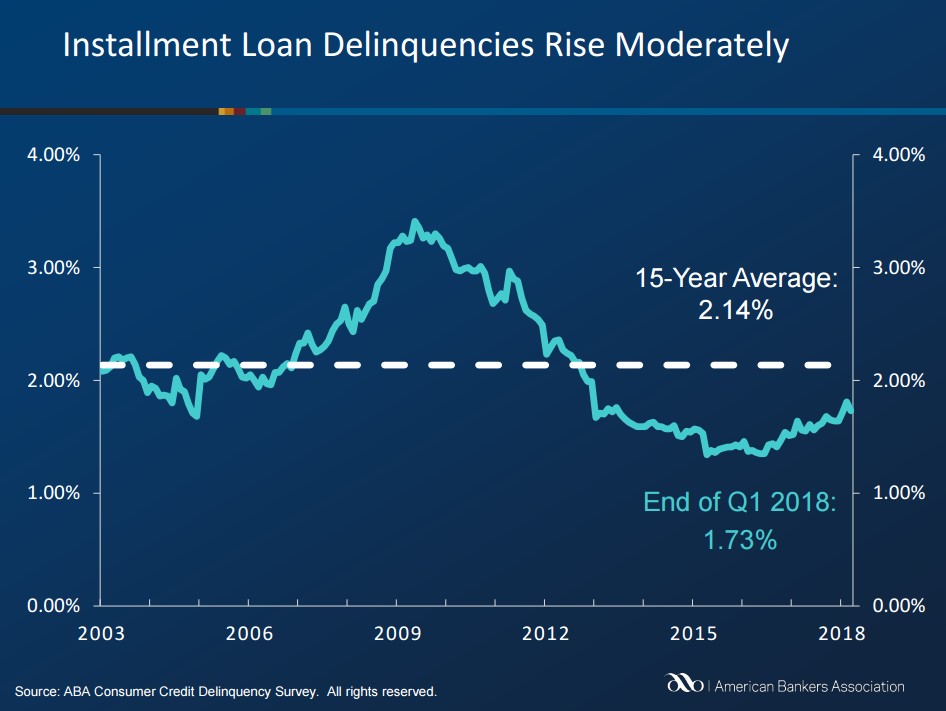

According to the American Bankers Association (the ABA), a banking industry trade group, the number of borrowers who are in debt is decreasing. [ https://www.aba.com ]

People who are more than 30 days overdue was 1.73% at the beginning of 2018, which is below the average of 2.14%. It means 25% of Americans repaid their debt.

The ABA which tracks such borrowers’ categories as bank-issued credit cards, home equity loans, auto loans and personal loans, says that a greater umber of households have better budget management. Finally, since early 2012, delinquencies fell in the 70s of 2018. It was supported by more than 10 million new jobs added.

Payday Loans are famous for being very easy and quick: a couple of minutes to apply and less than 24 hours to get your money. Anyway it is better to compare loan offers online, to make a right choice.

But on the other hand, they are known for being rather difficult to choose a reliable and inexpensivee one. The more lending companies you compare, the better. You get the opportunity to find the lowest APR and fees, the most comfortable repayment terms and other advantageous conditions. You can use special comparison websites such as Finder.com, Nerdwallet, COMPACOM, etc. COMPACOM is a real hit in 2018. It offers not only 3-5 popular old brands, but also newly-developed client-oriented companies who strive to get more customers, offeringg lower interest and better conditions. Whichever you choose, comparison services save time, providing information about the top lenders on one site and giving you the opportunity to fill out a free online form.

There appear a lot of new jobs, the wages and rates are getting better. So the decrease of delinquency is not surprising, states James Chessen, the ABA’s chief economist. , said in a statement.

Besides, a strong economy, lower unemployment and tax reform helped Americans are able to take debt repayment seriously.

They paid off $40.3 billion credit card debt at the beginning of 2018. [ https://wallethub.com ] Such high amount hasn’t been traced since 2009.

However, not all is so good with consumer debt. It comprised $1.02 trillion in credit-card debt in 2017 and remained so in April 2018. [ https://www.federalreserve.gov ]

Still most families do their best to pay the loans back which is rather difficult but to rising interest rates and debt burdens, says Greg McBride, the chief financial analyst at personal-finance website Bankrate [ https://www.bankrate.com ]

The banks hope the customers will continue to manage their budget and debts. They are not going to increase lending. The economy improves, and the borrowers will hopefully be able to handle the coming economic conditions”.